Deed of Appointment of Assets in a Trust

Our Deed of Appointment of Assets in a Trust template:

- Now over 100 sold!

- Distribute assets from trusts or will trusts

- Write deeds of appointment quickly

- UK-solicitor-drafted template for reliability

- Easy to edit to your own requirements

How Does It Work?

-

1. Download

-

2. Edit

-

3. Print

-

4. Sign

Our Deed of Appointment of Assets in a Trust template is for use where:

- there is a trust and the trustees are ready to distribute assets from it to a beneficiary of the trust, and

- the trustees wish to record that distribution formally, so they are using a deed of appointment.

You can also call such a distribution of assets from a trust an assent or an appointment. (Do not confuse it with appointing new trustees to a trust.)

At the time of writing, this is the only deed of appointment for this purpose available anywhere on Internet for purchase by the general public. Now over 100 sold!

We also offer a bare trust deed in a simple form if you do not already have a trust deed.

When to use our Deed of Appointment of Assets in a Trust

This Deed of Appointment of Assets template incorporates various options, so it is suitable where there is:

- a trust created by a trust deed or deed of settlement; or

- a trust created by a will and the testator has now passed away.

You can then use it to allocate assets from the trust to beneficiaries. Even if you are closing the trust, you can still use this deed of appointment to pass all the remaining assets to one or more beneficiaries.

This template is not appropriate for use where you:

- don’t have any existing trust deed or a will creating a trust;

- wish to appoint new trustees; or

- wish to remove trustees.

If multiple beneficiaries are receiving assets at the same time, is is probably easiest to use a separate deed for each such beneficiary. (You can reuse this template for the same trust as many times as you need to without paying again.)

If this relates to assets in a trust created by a will, you will need to have obtained Probate of the deceased’s estate before dealing with the assets, so only use this deed later on. In a will trust, the trustees might be different people to the executors of the will or might be the same people as the executors – the will will specify who they are.

You can read some basic information about English trust law on Wikipedia here: https://en.wikipedia.org/wiki/English_trust_law

FAQs on Deed of Appointment of Assets in a Trust

We have answered a selection of popular questions from the Internet below about these deeds below.

What is a power of appointment in a trust in the UK?

Where trustees hold assets in a trust, the trustees have the power to transfer assets out of the trust directly to the beneficiaries. Where there is a pool of possible beneficiaries in a discretionary trust, the trustees need to select which beneficiary or beneficiaries are to receive such assets. This is the “power of appointment”. Sometimes the trustees cannot exercise this power until the beneficiaries turn 18 or older.

What is a trust deed of appointment? What is a deed of appointment appointing out of a discretionary trust?

This deed is the document by which the trustees effect the appointment of assets to certain beneficiaries.

Do I need a deed of appointment?

You do not always need a deed of appointment. However, it is evidence that assets have been allocated in a discretionary trust to individual chosen beneficiaries out of the pool of possible beneficiaries in the trust.

Who signs a deed of appointment?

The trustees sign a deed of appointment of assets out of a trust. Usually 2 trustees are required for this.

How much does a deed of appointment cost?

We estimate a firm of solicitors would charge around £500 plus VAT for a deed of appointment of assets. You can make serious savings on this by using Legalo’s template.

Clauses in this Deed of Appointment of Assets in a Trust

Below, we have set out the main features of the guide to the template, so you can see what it comprises:

Date – Insert just the year at this stage. Handwrite the rest of the date in the agreement once the 2 trustees have signed it.

Party clauses – You will need to insert the name of the trust or a description of it (for example: the will trusts created by the will of [NAME] dated [DATE]), and the names and addresses of the two trustees who are to sign the deed.

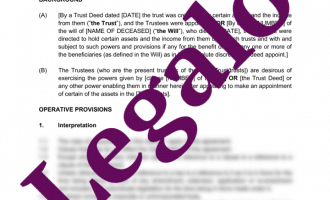

Background clauses

(A) Use the first option for a trust created by a trust deed. Complete the relevant details. Then delete the second option. Alternatively, use the second option for a trust created by a will of someone who has now passed away. So complete the relevant details. Then delete the first option.

(B) In the first part of this clause (and again at the end of this clause), choose:

- “Trust” if the trust was set up by a trust deed or

- “trusts” is set up by the will.

Delete the word which does not apply. Then in the same sentence, choose which option applies, depending on whether the trust was created by a will or not. If created by a will, fill in the number of the clause (or schedule) in the will which created the power of the trustees to appoint or distribute assets to a beneficiary of the trust.

Numbered clauses

1. Interpretation

Normally this clause defines the main terms used in the deed, but the will or trust deed should already define most of the terms used.

2. Appointment of Assets

This is the main clause in the Deed of Appointment of Assets, which states that the trustees are distributing certain assets to a single beneficiary. In clause 2.1, fill in the name of the beneficiary. If the trust named a pool of the possible beneficiaries, then the beneficiary should have been selected from that pool. In so doing, the beneficiary should be someone selected by the trustees in fairness (good faith) and in accordance with the rules of the trust.

At the end of clause 2.1, choose “Trust” if a trust deed set up the trust, or choose “Will” if the will set up the trust. So delete the word which does not apply. Then list the asset or assets clearly (you may find it best to use the same description from the trust deed or the will if applicable). Create further bullet points if the trustees are distributing multiple assets to one beneficiary at the same time. If the distribution is simply of a sum of cash, then state the amount.

Finally, the guide explains a couple of other boilerplate or standard clauses, and then goes on to explain how you sign the document as a deed.