Late Payment Reminder Letter

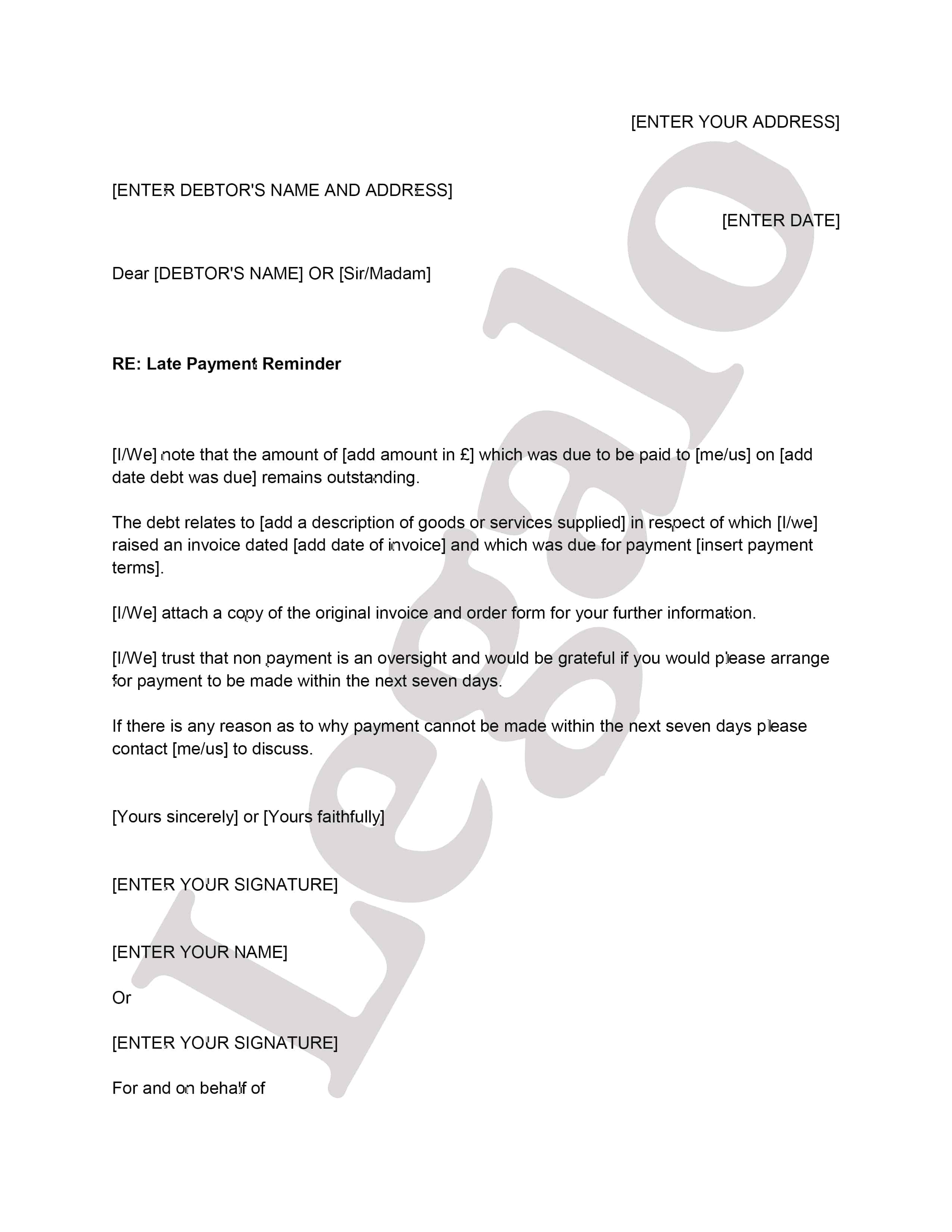

Our Letter Template:

- Use as a first reminder letter

- UK-lawyer-drafted for reliability

- Simple to complete

- Avoid bad debts early

How Does It Work?

-

1. Download

-

2. Edit

-

3. Print

-

4. Sign

MD, Legalo Ltd; Solicitor; Notary Public

This Late Payment Reminder Letter template is for chasing late payment of a commercial debt in the UK. Use it when an invoice to a customer is overdue.

When to use a Late Payment Reminder Letter

It is good credit control practice to send a late payment chaser letter as soon as the debt becomes overdue. Alternatively, if, it is, say, 28 days after the date of the invoice, and no payment dates were set, then send the reminder letter.

The letter reminds your customer that the invoice is overdue and the debt payable. It also invites the customer to raise any issues that they may have, so that you can address them.

Good Late Payment Practice

In most instances this initial late payment chaser letter will secure payment of the overdue amount.

If the customer has not paid you within at least 14 days of the debt’s becoming overdue (or 28 days after the invoice if no payment dates were set), you should promptly send a second reminder letter.

If a customer is struggling with their debts, they will generally first pay those suppliers that actively chase the debt.

At any point after the debt becomes a month overdue, you can then send a final demand letter before action. It is actually quite rare that companies have to sue as a creditor to recover commercial debts when they follow good credit control practices.

What To Include With Your Late Payment Reminder Letter

When you send the letter, make sure that you include a copy of the relevant invoice(s). If possible, also include a copy of the signed order form or any other means that you used to confirm the order. Including this information will ensure that the customer has everything that they need to see that the debt is indeed due and payable.

At this stage of the process, the reminder letter does not refer to the right to charge interest. Doing so runs the risk of upsetting the ongoing relationship with your customer if the late payment is an oversight.

Send this initial letter. Then, if the customer has not paid you within 14 days, escalate the process promptly. You can find the other letter templates to pursue the debt in our debt recovery letter templates section. That section lists all of the debt collection templates that we have.