Will For Couple With Children (Married or Unmarried)

Our Will for Couple With Children template:

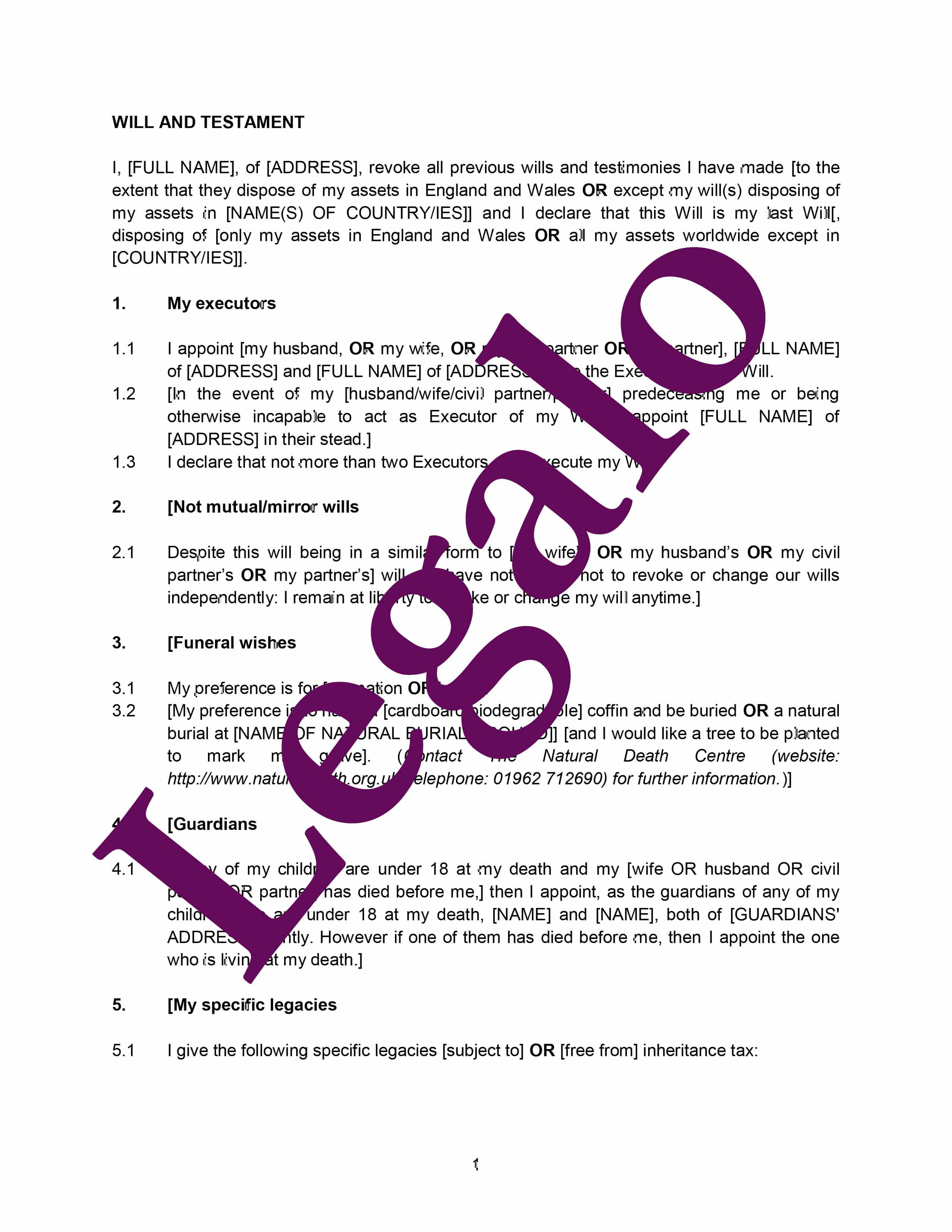

- has been drafted by a UK lawyer for reliability

- is suitable for married or unmarried couples

- includes detailed guidance notes

- takes about 20 minutes to complete both your wills!

How Does It Work?

-

1. Download

-

2. Edit

-

3. Print

-

4. Sign

This Will for Couple With Children template, for people with children, is suitable for both:

- married couples, and

- cohabiting couples.

It works for couples who live in any part of the UK – Northern Ireland, Scotland, England or Wales.

It is always a good idea to make a Will

Creating a will as a couple when you have children is a significant safeguard (which is even more important if you are unmarried) and ensures that your wishes will be implemented. This is particularly important for couples that are cohabiting because:

- they may otherwise not pass their estate to their partner, and

- child custody issues can be more complicated.

See our explanation of the issues here.

This will is a variation on our standard will template and has been created by David, our co-founder and solicitor of 30 years. He has edited it to make it specifically suitable for couples that have children, whether married or not. If you do not have children, then try our Will for Couple Without Children.

Why unmarried couples (with or without children) and people with step-children must make Wills

If you are cohabiting and do not make a Will, then the Intestacy Rules will apply to your estate.

As a result, all your assets might go to your children, as your legal next of kin, and your partner might:

- receive nothing on your death, and

- face the difficult and expensive prospect of making a claim against your estate, which may or may not be successful.

If your partner (married or not) has children (i.e. your step-children) who you have not formally adopted and who you regard as your dependents, then you need to make a will, in order to ensure you make provision for them. This is because, again under the Intestacy Rules, they would receive nothing. As dependents they might be able to dispute your lack of provision for them. However, this causes stress, wastes time and costs money. A simple solution to all this is just to make a will and set out what you want to leave them in it.

Not making a Will would certainly be traumatic and add more pain to their loss. You can rapidly solve these problems by making a Will based on our great Will for Couple With Children template. By taking 20 minutes to complete your will template:

- you will have protected your partner, children, step-children and yourself, and

- the Intestacy Rules will not then apply.

So don’t put it off any longer – you can both make your Wills in just a few minutes with Legalo’s great template.

Using our Will For Couple With Children template

Downloadable in Word format, our template comes with detailed guidance notes that walk you through each clause in the will template. You can download the template and the guidance notes, which we include, and then start writing your will at your computer straight-away. We offer a full money-back guarantee, so if you are not completely happy with the document, for any reason, you can request a full refund.

If you would like to see the full range of our Will templates, just click here.

FAQs on the Will for Couple with Children

Below, we have addressed the top questions on this topic from the Internet.

What is the best will for a married couple with children?

As a married couple with children you will usually want to write what are known as “mirror wills”. These wills are written almost identically and will usually leave the assets owned individually to the other spouse if they survive you and then ultimately to the children on the death of the second spouse. You must consider your intentions and what you would like to do with your sole assets. Other factors to consider are guardianship of children.

At Legalo, we have great mirror wills that you can use right away, without any fuss or having to pay for expensive legal fees. They cover all of the necessary issues. Make yours today without delay.

Do you need a will if you are married with children? What is the best type of will for a married couple?

As we have mentioned already, as a married couple you will usually want to draft mirror wills, leaving the surviving spouse all, or the majority of, your assets, which will then pass to your children on the second death. Mirror wills mean that you will each have your own will but they both reflect the above position.

Can a married couple make separate wills?

Yes, a married couple can make separate wills. There is no rule that married couples have to leave all their assets to the other, although this is the norm. Each spouse can create their own individual will to address their specific wishes and dictate the distribution of their own assets or their share of jointly-held assets, other than:

- houses held as joint tenants, and

- jointly-held bank accounts.

For a house that is held as a “joint tenancy”, this means the survivor inherits the deceased’s share automatically. If you want to do something different, then you need to “sever” the joint tenancy and convert it into a tenants in common basis. To do that which is very simple, see our template.

Separate wills offer more flexibility and allow each spouse to account for their individual assets and choose their own beneficiaries.

Should married couples share inheritance?

The decision to share inheritance between married couples depends on individual circumstances and preferences. In some cases, couples may choose to combine their assets and jointly manage the inheritance. In other situations, spouses may keep inheritance separate to protect individual interests. Open communication and mutual understanding are essential to determine the best approach for each couple. Seeking advice from a financial advisor or legal professional can help couples make informed decisions about inheritance management and financial planning.

When you receive an inheritance it is a discussion between you and your spouse as to whether you jointly manage the money/property/goods you have received or if you manage it separately. You may need to consider tax implications and the assistance of a financial planner may help you with this.

Does a will override marriage rights UK?

Yes, a will can override marriage rights in the UK. While marriage grants certain automatic inheritance rights to spouses only if you make no will, a valid will can supersede these default provisions. A person can specify in their will how their executors shall distribute their estate, including assets that may not automatically pass to their spouse.

However, the law in the UK ensures that a surviving spouse who was a dependent of the deceased can make a claim against the estate for a fair share if they have been disinherited in the will. It is essential therefore to consider making a fair provision for the surviving spouse. If you choose a will from Legalo, a very experienced lawyer, with 30 plus years of experience, has prepared it.

Do wills include stepchildren?

You can mention your stepchildren in your will, if you so choose. If they are dependents, then you should make a fair provision for them in your will. If you do not, they could dispute your estate. You must ensure that you mention them by name as beneficiaries and explain in your will what it is that you want to leave them after you have died.

If you fail to make a will and intended to leave something for your stepchildren, unfortunately the Intestacy Rules leave nothing to therm. We have warned about this issue above. So a stepchild cannot automatically inherit anything from your estate unless you make a will. The only children who inherit under the Intestacy Rules are:

- children who are biologically your children, or

- you have legally adopted.

How can I protect my inheritance from my marriage?

To protect your inheritance from your marriage, consider the following steps:

- You may wish to create a pre-nuptial or post-nuptial agreement, detailing what would happen to your inheritance in the event of a divorce. Both spouses would need to agree on such an agreement for it to work.

- Keep your inheritance in a separate bank account and avoid co-mingling it with marital assets.

- Consider setting up a trust to protect assets and control how they are distributed.

- Update your will to specify how you want your executors to deal with your inheritance upon your death.